22+ montana paycheck calculator

Montana Income Tax Calculator 2021. The Montana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Montana State.

822 River Gorge Rd Superior Mt 59872 Realtor Com

The state income tax rate in Montana is progressive and ranges from 1 to 675 while federal income tax rates range from 10 to 37 depending on your income.

. Some states follow the federal tax year some. So the tax year 2022 will start from July 01 2021 to June 30 2022. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

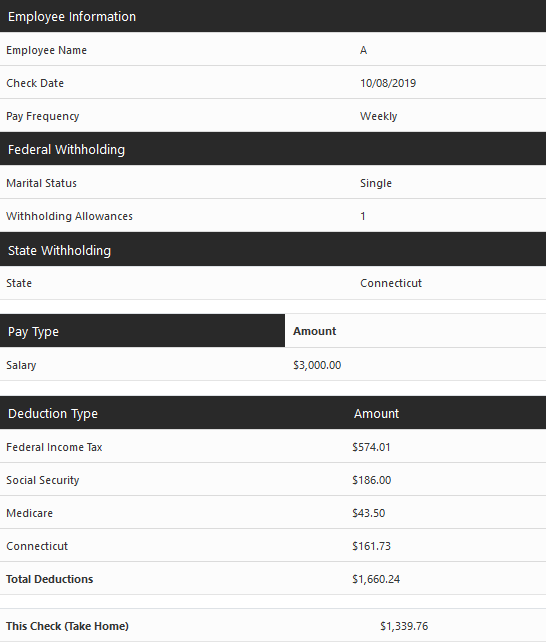

The information contained on this page is intended for State of Montana employees who need to understand child support. The 2022 rates range from 1 to 675 on the first 35300 in wages paid to each. Calculate your Montana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Montana.

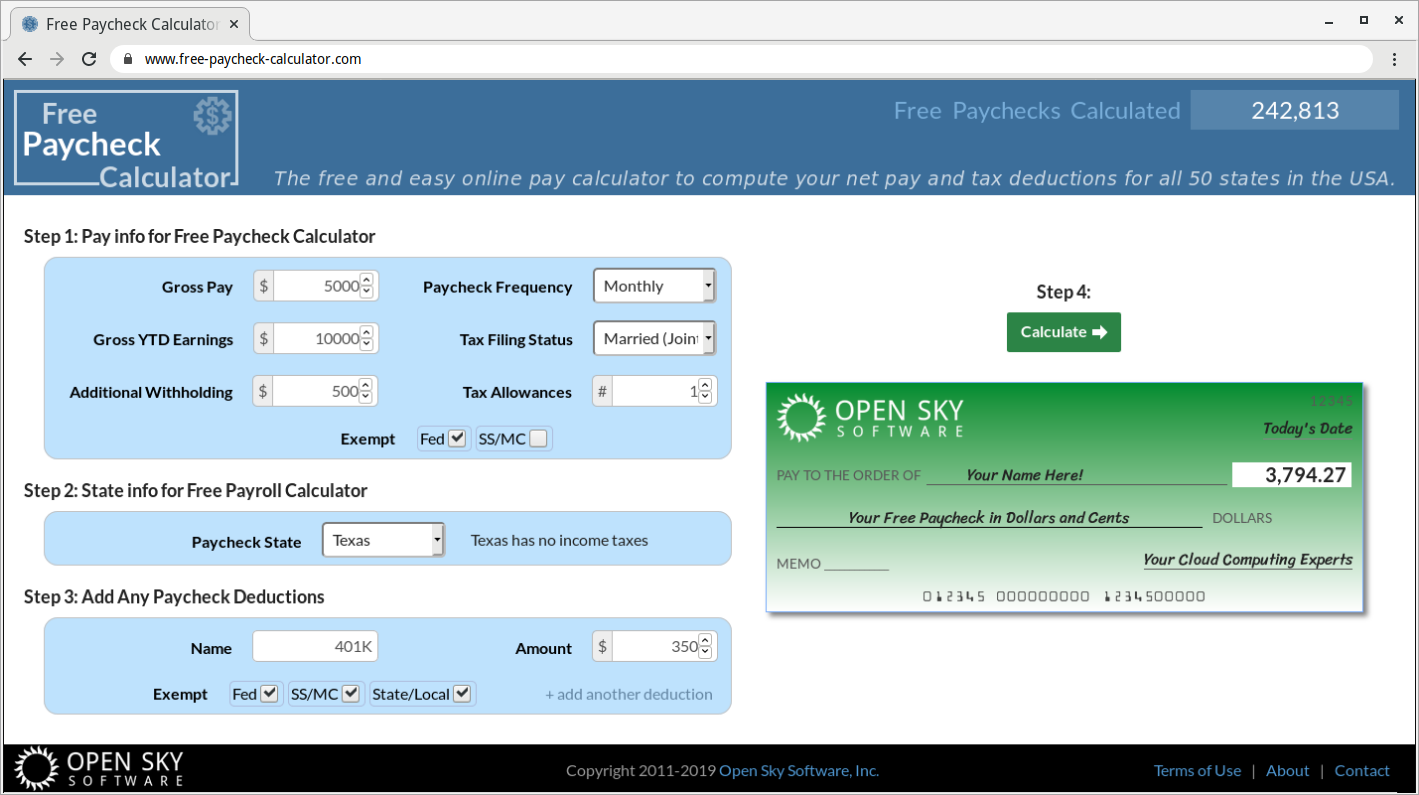

Supports hourly salary income and multiple pay frequencies. Use ADPs Montana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Montana Hourly Paycheck and Payroll Calculator.

This free easy to use payroll calculator will calculate your take home pay. Need help calculating paychecks. It is not a substitute for the advice of.

Just enter the wages tax withholdings and other information required. Back to Payroll Calculator Menu 2013 Montana Paycheck Calculator - Montana Payroll Calculators - Use as often as you need its free. This Montana hourly paycheck.

Enter your info to see your take home pay. Calculating your Montana state income tax is similar to the steps we listed on our Federal paycheck calculator. If you are looking for general child support questions or are not a State employee but need information about your child support contact the Montana Child Support Enforcement Division at 406 444-9855 or toll free at 1-800-346-5437 in state only.

As an employer in Montana you have to pay unemployment compensation to the state. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your. Payroll pay salary pay check.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Montana residents only. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

If you make 70000 a year living in the region of Montana USA you will be taxed 12710. The state tax year is also 12 months but it differs from state to state. Your average tax rate is 1198 and your marginal tax rate is.

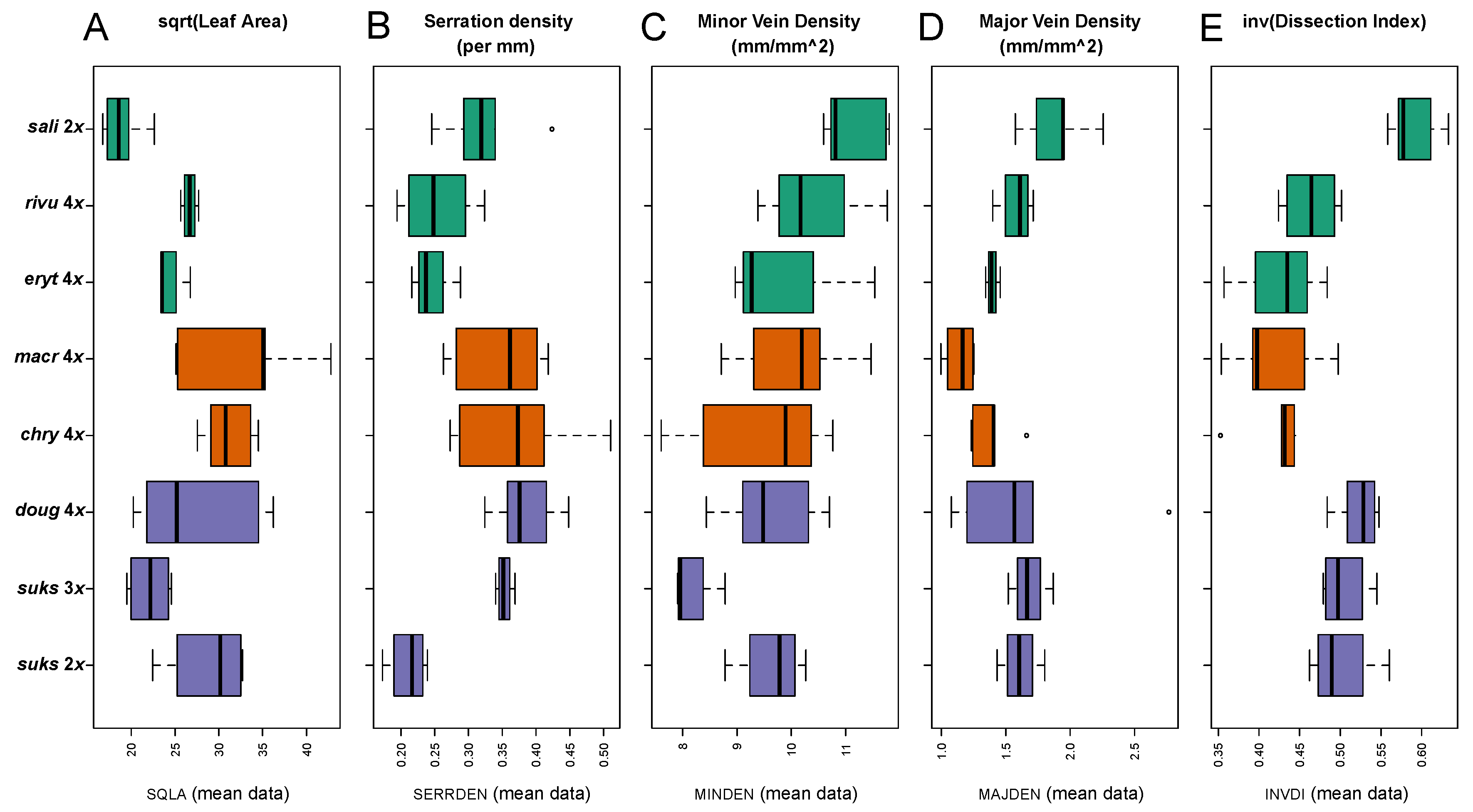

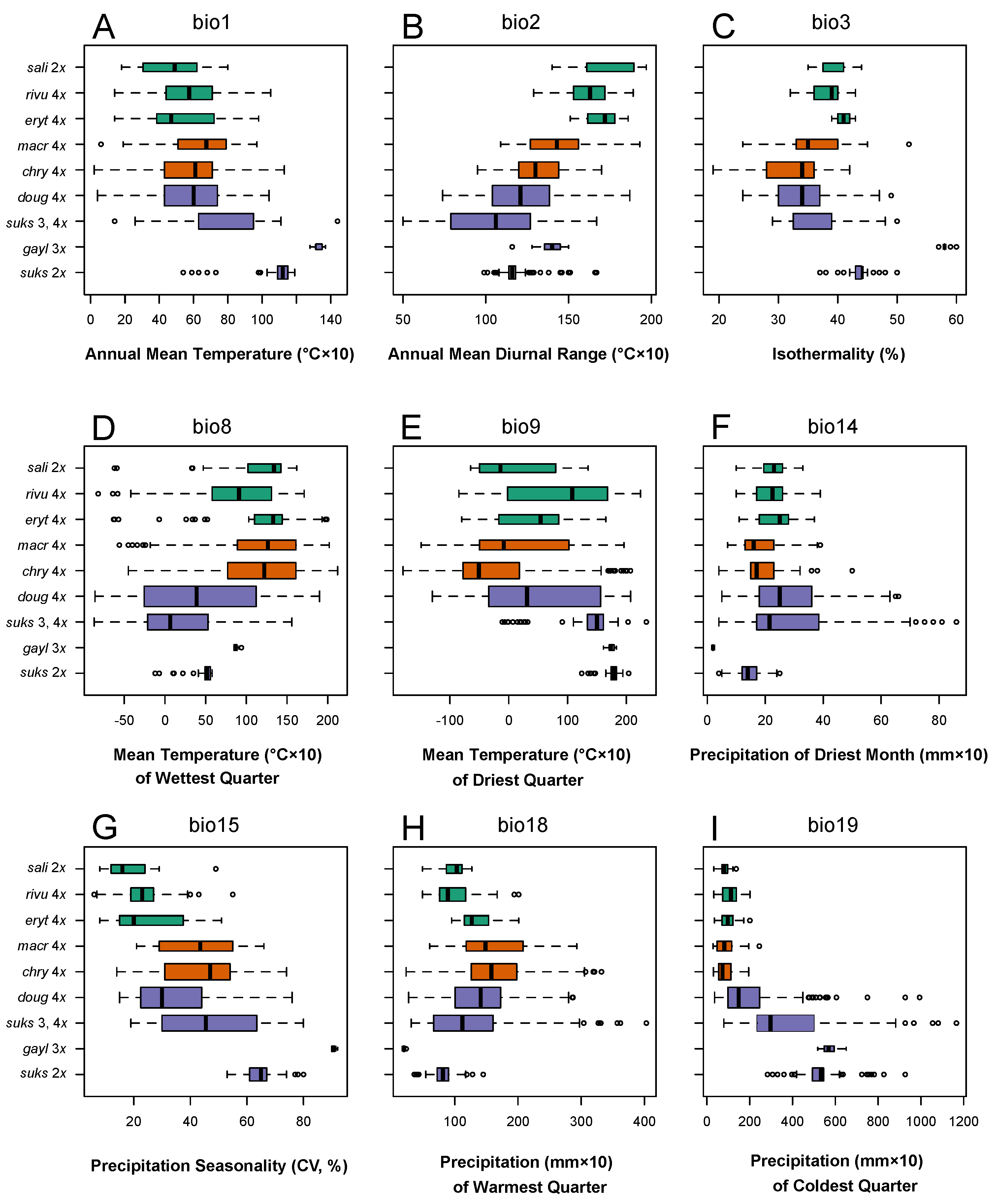

Agronomy Free Full Text Niche Shifts Hybridization Polyploidy And Geographic Parthenogenesis In Western North American Hawthorns Crataegus Subg Sanguineae Rosaceae Html

12 Best Realtors In The Us 2022 Rankings Houzeo Blog

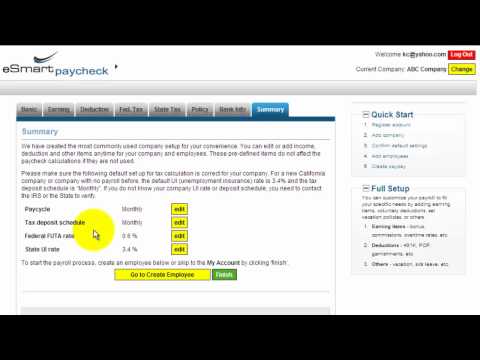

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Is 10 A Day To Spend On Whatever I Want Too Much Quora

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

3 12 154 Unemployment Tax Returns Internal Revenue Service

Montana Salary Calculator 2022 Icalculator

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Free Paycheck Calculator Hourly Salary Usa Dremployee

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

About Free Paycheck Calculator

Galaxy S22 S22 Kaufen Preis Angebote Samsung De

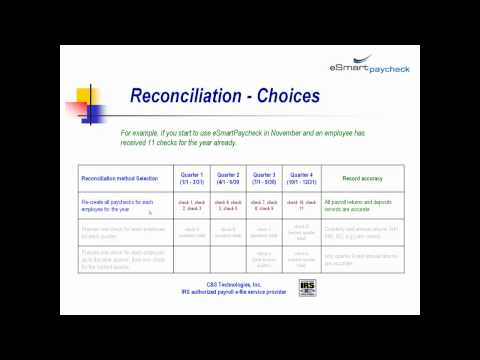

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

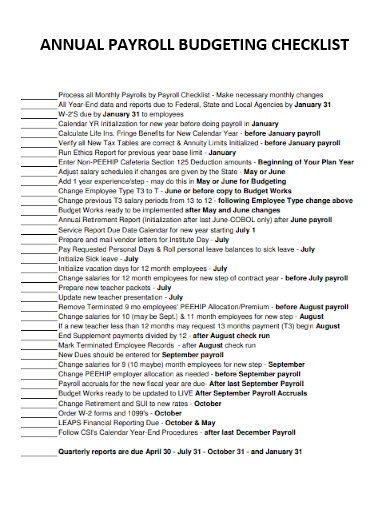

Free 10 Annual Payroll Budget In Ms Word Google Docs Google Sheets Ms Excel Pdf

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Montana Salary Paycheck Calculator Gusto